What To Do If A Client Doesn’t Pay For Your Work

My relationship with Elon Musk — True story.

Over my 20 years of experience in business, I’ve come across many clients who ghosted me after I sent my invoices.

Some were late, so they eventually paid after months and years.

Some never paid up to this day.

And I’ve never sought legal help so far.

I believe if you are ever in this situation as a service provider, you would not wish to spend upfront cash on legal fees first.

That is always the last resort in my opinion.

But, if you are not getting a fair exchange for your service and not getting any response from clients, what are you going to do?

Here are steps I went through after a client named Twitter was acquired, thanks to Elon Musk.

Step 1: Don’t Be Mean

First of all, if your clients failed to pay you on time, ghosted you or refused to pay you for some reason, don’t be unfriendly.

But don’t be overly friendly to your clients either.

You may never know if they may need help themselves, so be kind.

My team has been working with Twitter for years. They had a payment term that was so long, I could have included extended interests.

Of course, I didn’t, our pricing has always been reasonable.

You can check us up on that.

Anyway, those days, we were busy in a good way with Twitter they paid us as invoiced.

For the life of me, one fine day, Elon Musk's acquisition of Twitter has to happen just before I would have received my biggest payment from them.

While Twitter was drowning in lawsuits, I was getting mentally ready not to get paid forever.

But, my team worked hard on the projects, and I must do something to compensate them.

Step 2: Send An Email

Meantime, I’ve paid my team for the work they’ve done.

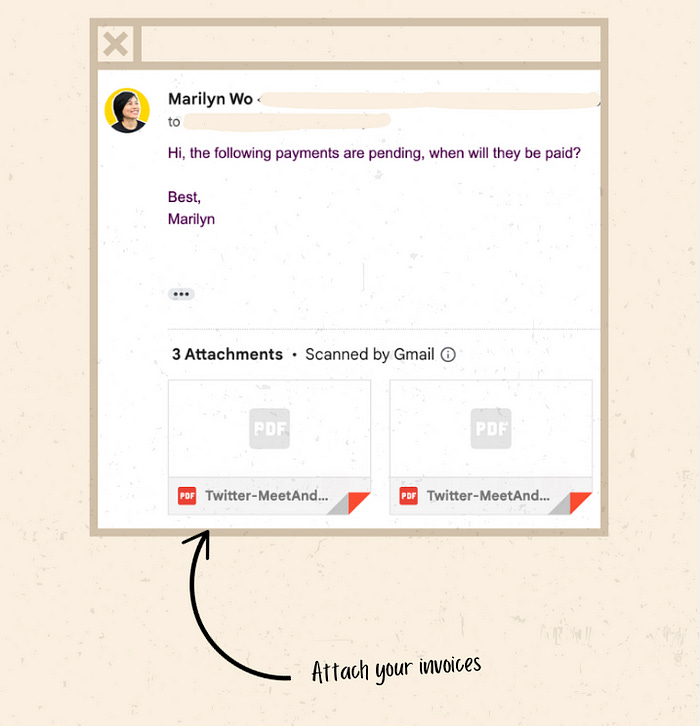

Here’s the template of my first email:

Oh boy, was I ignored.

Nobody from finance answered my email.

Don’t expect anyone to do so.

Trust me,

I was furious.

In fact, I emailed every week and was ignored for months.

I was seconds away from tweeting Elon Musk.

But no.

Don’t do that.

Even if you like that kind of drama, never do that.

You’ll be seen as a hater.

Meantime, I stayed calm and whipped out my trump card before taking legal action.

Step 3: Send Another Email

At this point, I’ve already sent at least 40 emails between these 2 steps.

I was sending reminder after reminder after Twitter ghosted me for 11 months and 10 days with unpaid contracts.

Why am I not getting legal help?

I have a few friends who are lawyers by profession and their advice was not to send a legal letter to the other party right from the start.

The way to do it is to do all you can to avoid lawsuits first, as much as you can.

Then, let them know you will be sending a debt collection letter with a “soft” request for payment.

The reason for this is that not only will you have to fork out legal fees for a lawyer’s help, but you will also need the other party’s (client’s) reciprocity to agree to appear in court.

This sounds like more effort on my part.

So I thought of the next best thing to do with the least effort, and time required, no extra costs involved.

I decided to send another simple email.

This time with a deadline.

Here’s the template:

What did you know?

The day after my email, they finally replied.

The Last Mile

We went through some exchanges of negotiations, yes, they negotiated due to their “dire” situation.

Negotiation 1

Their reason is, that since acquisition, “their leadership has to approve every dollar that leaves the company and that makes it hard for them to process invoices.”

They proposed to pay back with a one-time discount of 25%, and if agreeable, I will be paid in 5 days.

As for why they had to take almost a year to make payment?

According to them, they have “suffered a 90% reduction in headcount since the acquisition. This has caused many of their vendor invoices to be delayed or even lost from former employees leaving the company.”

I just couldn’t agree with this, because if I were owed $100, with 11 months outstanding, I can rightfully ask for add-on monthly interests.

I was asking for the exact payment, and if according to Business Insider, Elon Musk is worth more than $200 billion, how hard would it be for him to find less than a fraction of that to pay small contractors like me?

So I sent another email of rejection.

Here’s the template:

Negotiation 2

I was pretty pleased with my email, thinking I pulled it off quite well.

Then, they replied to say, “I’m able to approve invoices under $8000. If you can meet me there, I can have payment delivered in 5 business days.”

Not quite what I was looking for.

I would have to account for the rest of the outstanding payment from $8000 onwards, and it doesn’t sound fair.

So I responded with my second “try to be emphatic” email.

Here’s the template:

In this email, I am showing that I’m grateful for their help and understand their plight.

So I tried to resolve this by allowing them to pay the first $8000 and the rest by another deadline.

This shows them that I do not agree with their proposal of reduced payment.

But I’m fine with shifting the deadline if they do partial payment.

5 days later, they finally made the FULL payment.

Takeaways

Give A Deadline

If you are also in this situation, I don’t wish you to spend a year sending emails to the void.

You may wish to give a deadline from the get-go, about one or two months down the road.

Then, in between that, send weekly reminder letters about the deadline. This gives them ample time and no excuses to prepare the payment.

Don’t mention anything that has to do with the legal (yet). Just a deadline is a good implication that if they missed that, the next thing would be for you to take legal action.

They wouldn’t wish to go through the hassle of appearing in court if they knew they would not win the case anyway.

So I believe, they will respond with deadlines.

Get Paid Before Service Starts

The best way to run a service business is to ask for an upfront payment.

I know this could be hard because you don’t wish to chase away your prospects.

Why would clients pay you upfront?

Here are the 3 reasons I’ve found:

Shows commitment: Upfront payment means you are doing serious business. It also allows your clients to be sure of their commitment before proceeding. This also shows your side of the commitment, reducing perceived risks on their end.

Builds trust fast: You are not just asking for payment. To ask for payment first, you must have deliverables promised right from the start, with expectations laid out clearly with a timeline. This shows clients you are confident with your work, all the more they want to work with you.

Better cash management: If I were the client, I’d want to spend only what I can afford. I’d want to pay upfront, after due diligence, not just to avoid interest, but to make sure I’m buying something I can afford with available cash.

On the flip side, you don’t know what the client wants, you wouldn't know how much to bill at the start.

Here are 3 ways to do it:

Productize your services: Know what you want to deliver right from the start and package up your deliverables like a product. Then tag a price to it and offer that to your client with a fixed price.

Comparison payment: Allow clients to pay 100% full after delivery, but if they pay upfront 100%, it’s 20% less than if paid later.

Partial payment: Allow clients to give partial payment, such as 50% before work starts and the other 50% to be paid after completion.

If you want to go deeper, I have a course to help you build a service business to bill upfront like selling a product.

Check it out here: Productized Kit

I hope my personal experience has helped you with some options to be paid in full for any work you do in business.

❤️ Get some freebies at my Gumroad store

☕️ If you feel my work is worth an appreciation, you can buy me a coffee!

🚀 If you haven’t already, join my weekly newsletter Very Good Productized Guides

This stressed me out so much, it never occurred to me that you might not get paid for work you've actually done